Petrobras (PBR): Still Double |

您所在的位置:网站首页 › per pbr 股票 › Petrobras (PBR): Still Double |

Petrobras (PBR): Still Double

|

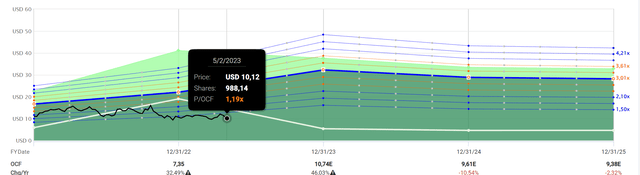

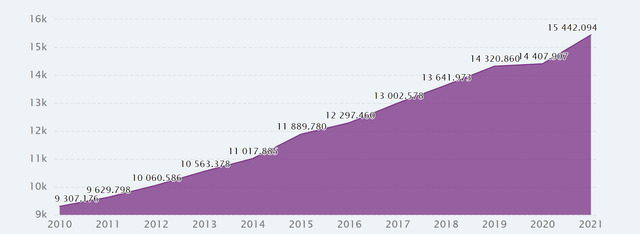

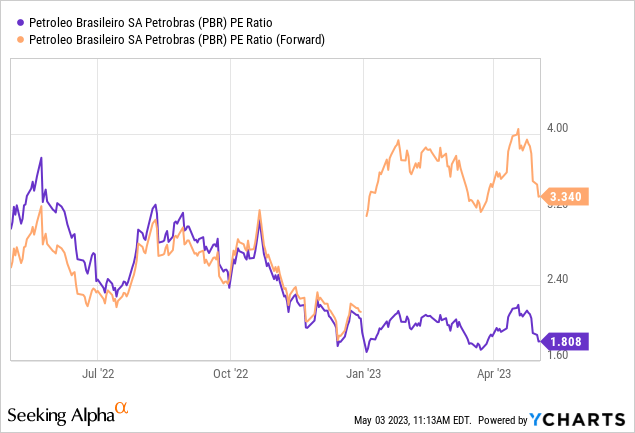

pandemin Investment ThesisInvestors are still uncertain about Petrobras (NYSE:PBR, NYSE:PBR.A), which leads to a very cheap valuation compared to other companies in the sector and its own historical comparison. The 2023 EPS are likely to be significantly below those of 2022 but still yield enough to still pay between 10% and 20% dividend yield. In addition, the CEO recently said that oil production remains a top priority. ValuationIn my last bullish article from the end of November, I argued that political risks exist (as there are currently political risks in the oil sector worldwide), but these risks were priced in to such an extent that the stock was cheaper than during its biggest scandal in 2014/2015. Here is an excerpt: According to Wikipedia, the first investigations into the scandal began in March 2014. In addition, there were also declining revenues in the following years. The lowest valuation between 2014 and 2017 that I could find was a P/OCF of 0.96. The average valuation was between 2.5 and 3. And today? According to Fastgraphs, we are at a P/OCF valuation of 0.90. That was in November. Today we stand at a P/OCF valuation of 1.19. Note that Fastgraphs states that the historical normal is a P/OCF of 3.01. If the share would trade that high, the price would have to be around $25 currently.

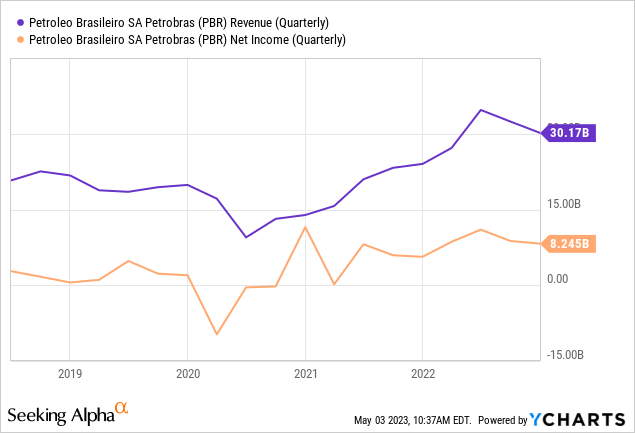

fastgraphs If we look at the 1-year graph, we can see that a similar bottom at $9 - $10 has been tested several times but has never been undershot. Instead, there is currently a sideways movement - which is not so bad for the shareholders since they still receive double-digit dividends.

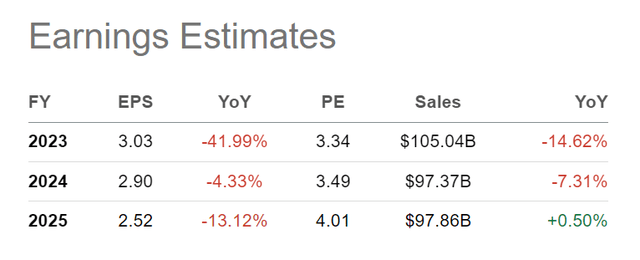

Seeking Alpha Of course, 2022 was a record year in terms of revenues, which will not be repeated this year. The market is aware of this, and the repeated testing of the bottom shows us that this is already priced in. In addition, nothing has changed fundamentally recently, but the share is still trading at the lower end of its 52-week range (see the right column of the chart above). But despite a 42% drop in EPS, this would only correspond to a P/E of 3.3

Seeking Alpha Long-term outlook and renewablesFirst, I would like to mention what the company says. The CEO recently said that "oil production will remain a top priority."

In comments that may ease concerns among some investors that Brazil's new administration would prioritize non-core investment projects over oil and gas, Prates said oil output will remain the company's top priority while investment in wind and other renewable energy will be modest in comparison. Prates said Petrobras - which paid a record dividend last year - should strike "more balance" between sending cash to shareholders and investment. S.A. News There are many interesting details in this short quote. In past articles, I had already suspected that Petrobras would follow the path of other large companies (Shell, Equinor) and diversify itself into renewable energies. This seems to be confirmed here, but according to the CEO, "modest in comparison." So in combination with what he says about the dividend, it seems that some of the money that has been paid out so far will go into investments in renewables. Is that so bad if Petrobras finds the right balance? I don't think so; after all, this is not wasted money but an investment in power generation that will generate cash flows in the future. However, these are investments for several years that do not pay off quickly. Therefore, this is a point where shareholders should look at how high the investments will be. Unlike Shell, Petrobras seems to be taking a less radical approach, as Shell says oil and gas output will decrease by 18% by 2030. In contrast, Petrobras:

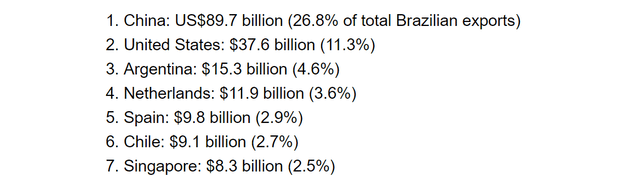

Brazil's fossil fuel production is poised to reach a record 3.4M bbl/day this year and keep growing until 2030; the country would then need new discoveries to maintain and grow output. The CEO said Petrobras must exploit existing finds in the pre-salt areas and find fresh ones, while also opening new basins in other parts of Brazil, including the region in the far north of the country near Guyana, where Exxon has found billions of barrels. S.A. News Brazil and ChinaAnyone who has followed the political events of recent months knows that the Brazilian and Chinese presidents have excellent relations. This is unsurprising because China is Brazil's most important trading partner. They are also partners in the BRICS coalition.

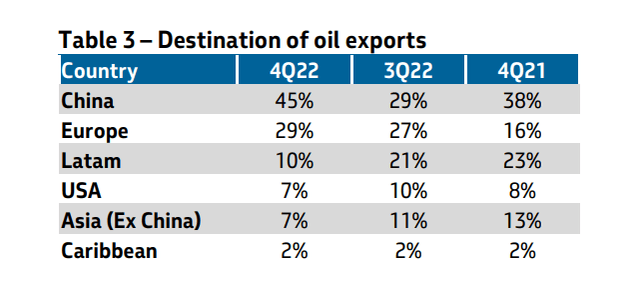

worldstopexports.com According to Petrobras' fourth quarter results, China's share in oil exports is even larger, and Europe's share has almost doubled.

Investor presentation In addition, China's oil consumption is still growing rapidly and is second in the world behind the USA.

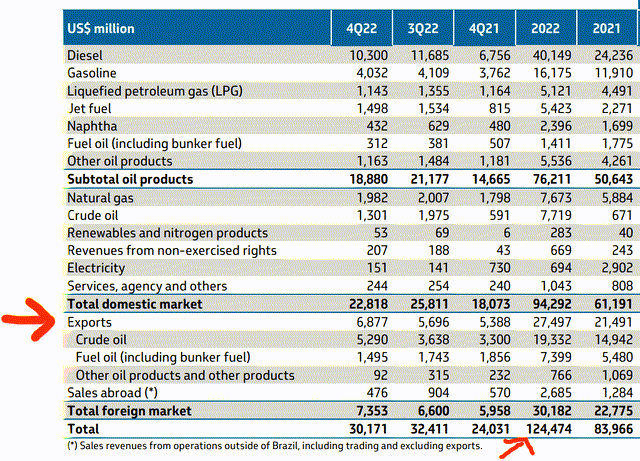

ceicdata.com In summary, this means that Brazil has large markets with China and other countries that are energy hungry, and there is nothing to suggest that this will stop in the next few years. The less oil Europe wants to buy from Russia, the more they need from other countries; Brazil is an ideal candidate, and we see exports rising sharply. Moreover, the revenues are essential for the Brazilian state. In its last quarterly report, the company said it paid the equivalent of $55B in "taxes and government take" in 2022. Fears about a self-destructive course of the Lula government are unfounded. At least so far, there are no indications of this. It cannot be ruled out completely since the West is now pursuing a kind of self-destruction course in some areas. But from my point of view, Brazil ties itself to the growing bloc of BRICS countries. In addition, the company currently benefits indirectly from the decisions of Western countries in relation to their fossil fuel industry as well as from the decisions of OPEC+; recently a significant production reduction. In other words, Petrobras benefits from the fact that the most powerful market participants will ensure that oil prices do not fall too low. Diesel and OilHowever, it should be noted that oil exports represent a relatively small part of Petrobras' revenues, about 15%. In total, exports will account for $30B of the total $124B in 2022, 32% more than in 2021.

Investor presentation Domestic diesel and gasoline sales are the largest revenue source, accounting for almost half. As shown earlier in the earnings estimates, the market expects EPS to be 42% lower in 2023, and I suspect this has a lot to do with diesel. Compared to 2022, prices are down significantly, and I assume political pressure is also at play. Recently, there was a 4.5% price cut in March. We will see how much of a difference this makes in the end because lower prices also increase demand, and according to the OECD, the Brazilian economy grew by an estimated 2.8% in 2022. Overall, Brazil is a country where gasoline demand is still rising. Like analysts, I expect 2023 revenues to be significantly lower than 2022, but that is probably fully priced in. Even after this drop, the forward P/E ratio will be only 3.3.

The last dividend related to Q4 was $0.55.

Our Board of Directors approved dividends of R$ 2.751 per common and preferred share, relative to 4Q22 results. And we can continue to deliver even more. With the perspectives on oil and gas production growth, with higher profitability due to the pre-salt, and the capacity of our company to face the challenges imposed by the inevitable energy transition we shall be in a unique position to continue to generate long term value. It is obviously worth noting that we cannot ignore the cyclical nature of our industry: who can forget negative oil prices during the height of the pandemic? In 2022 our return on capital employed was 16%. In 2020 it was only 3%. Therefore, we need to focus on our portfolio鈥檚 resilience, ensuring long term financial sustainability Q4 2022 report According to their report, they spent about $4B on dividends which is about a 50% payout ratio.

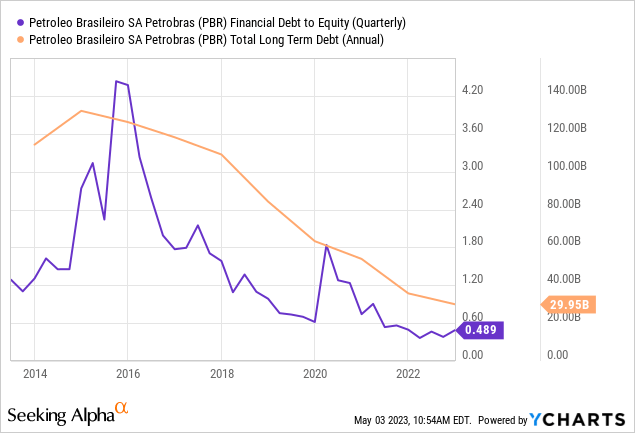

What can shareholders expect in 2023? As shown in the earnings estimates above, EPS is expected to be 42% lower this year, corresponding to about $3 per share. If the payout ratio of 50% is maintained, this will lead to a dividend of $1.5 per share or a dividend yield of 15%. So no longer enormously high figures as in 2022, when one could look forward to a yield of 30% or more. RisksWhether all the above factors are worth the risk to an investor must be decided individually. Of course, there are also several risks. For one thing, the dividend payout ratio could be lower in the future, bringing the dividend yield down to 10% or less. I suspected in this article that political pressure exists to lower gasoline prices domestically in Brazil. This pressure could continue, resulting in further price reductions. This would be catastrophic for the company's revenues because this is the main cash cow. It is also necessary to wait and see to what extent the company will enter the renewable energy sector and how high the investments will be. If several of these factors come together, there could be very little net income left, and that would be the end of the share as a dividend king. DebtI want to mention the debt briefly, as I have highlighted this in several of my past articles. In the meantime, the debt is so low that it is hardly worth mentioning in relation to the cash flows. This leads to significant savings in interest payments: in 2016, the company spent $6.4B on interest, and in 2022 only $2.6B (income statement).

Overall, I still believe that the risks are sufficiently priced in. What could shock the share now could be a political black swan. A push towards nationalization or the government forcing the company to cut its oil production in the next few years. In contrast, the company has several tailwinds, such as a generally growing Brazilian economy, higher domestic gasoline demand, and more demand for oil exports. Several factors could lead to rising oil prices this year, which would again benefit Petrobras: US strategic oil reserves soon to be exhausted, OPEC production cuts, and increasing Chinese demand. Overall, I believe this is most likely a stock that can be held for years (obviously, unless political risks manifest themselves). The stock is volatile, but I don't see much downside at current prices. If the stock ever returns to historical average valuations, it should double or triple; and if not, you still get double-digit dividend yields. |

【本文地址】

今日新闻 |

推荐新闻 |

Data by YCharts

Data by YCharts Data by YCharts

Data by YCharts Data by YCharts

Data by YCharts